Running a business in Saudi Arabia today requires more than traditional bookkeeping or manual financial tracking. With the Kingdom’s fast-growing digital economy, new tax regulations, and rising competition, companies need accurate, automated, and highly compliant financial systems. This is where modern accounting software in Saudi Arabia becomes essential.

From VAT-compliance to cloud accessibility, automated payroll, ZATCA e-invoicing, and advanced financial reporting—today’s accounting tools help businesses save time, reduce human error, and manage finances with complete confidence. Whether you operate a small shop, a startup, or a large enterprise, choosing the right accounting software can significantly improve efficiency and overall business performance.

In this guide, we’ll explore why accounting software is important in Saudi Arabia, key features to look for, the top solutions available in 2026, and practical tips for choosing the best platform for your business.

Why Accounting Software Matters in Saudi Arabia

Accounting software in saudi arabia business environment is evolving rapidly due to:

. ZATCA e-Invoicing Requirements

Since 2021, the Zakat, Tax and Customs Authority (ZATCA) has required Phase 1 and Phase 2 compliant e-invoicing solutions. Having accounting software with built-in ZATCA integration ensures you can issue electronic invoices, stay compliant, and avoid penalties.

. VAT Compliance

Since VAT was introduced in 2018 and later increased to 15%, companies must ensure real-time tax calculations, accurate reporting, and digital records. Accounting software automates this entire process.

. Growing Digital Transformation

Under Saudi Vision 2030, all sectors are moving toward full digital adoption. Cloud accounting helps businesses operate remotely, monitor finances anytime, and integrate operations with POS, CRM, inventory, and HR.

. Faster Decision-Making

Real-time dashboards, analytics, and automated financial reports help business owners make informed decisions, improve cash flow, and predict future financial performance.

Top Features to Look for in Accounting Software in Saudi Arabia

When choosing accounting software, make sure it includes the following key features:

✓ ZATCA Phase 1 & 2 E-Invoicing

Ability to generate, store, and report e-invoices in the required XML format with a QR code.

✓ VAT Automation

Automatic VAT calculation, reporting, and filing preparation.

✓ Cloud Access

Work from anywhere—laptop, desktop, tablet, or mobile.

✓ Arabic & English Support

Bilingual systems make it easier for all teams to manage financial operations.

✓ Inventory Management

Stock control, purchase orders, item tracking, and supplier management.

✓ Payroll & HR Integration

Salary calculation, employee management, GOSI compliance, and WPS support.

✓ Financial Reporting

Balance sheets, profit/loss statements, cash flow reports, trial balance, and more.

✓ Bank Integration

Automatic reconciliation, transaction tracking, and secure banking connections.

✓ Multi-Branch / Multi-Currency

Essential for companies operating in multiple locations or dealing with international clients.

Top Accounting Software in Saudi Arabia for 2026

Bnody Accounting Software

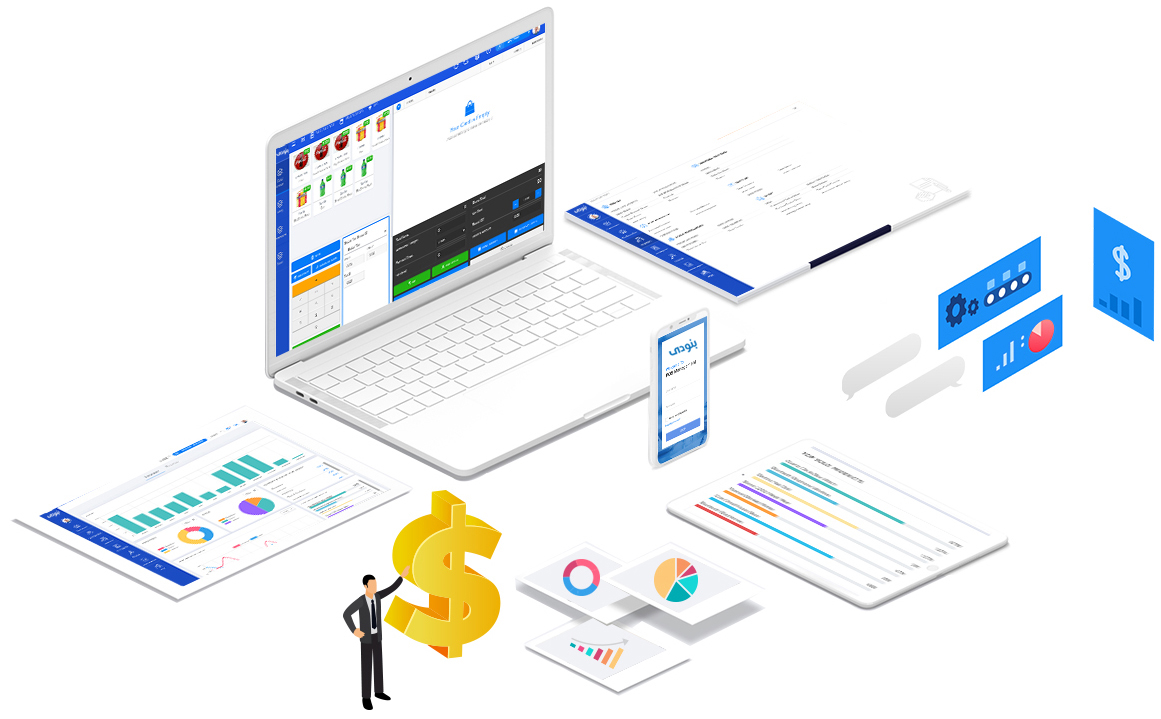

Bnody is a popular Saudi-based accounting and business management solution known for its simplicity, automation, and full ZATCA Phase-2 e-invoicing compliance. It offers:

- Cloud-based access

- Smart financial reporting

- POS integration

- Multi-branch support

- Inventory + HR + payroll

- Seamless VAT and ZATCA compliance

This makes it ideal for SMEs, retail shops, wholesalers, restaurants, and service companies.

Zoho Books

Zoho Books is one of the most used accounting solutions globally and fully supports Saudi VAT rules. Popular features include:

- Automated banking

- Mobile app

- Purchase & expense tracking

- Project billing

- ZATCA-compliant e-invoicing (with approved providers)

QuickBooks Online

A strong option for small and medium businesses requiring cloud accounting. Features include:

- Easy invoicing

- Payroll integration

- Tax management

- Multiple payment gateways

QuickBooks is widely trusted but not fully localized for Saudi laws compared to Bnody or Zoho.

Xero

A modern cloud platform with intuitive dashboards and strong expense management. Xero supports:

- Real-time financial visibility

- Project tracking

- Multi-currency finance

However, ZATCA compliance usually requires third-party integration.

Sage 50 Middle East

A robust enterprise-grade system suitable for companies that need advanced tools. It offers:

- Extensive accounting modules

- Payroll & HR

- Inventory & warehouse management

- Detailed financial reporting

Sage is powerful but more costly than cloud-based alternatives.

Benefits of Using Accounting Software in Saudi Arabia

Save Time & Reduce Errors

Automated calculations, reports, and invoices help businesses avoid costly mistakes.

Improve Financial Visibility

Real-time insights help owners track profit margins, expenses, and cash flow easily.

Ensure Complete Compliance

ZATCA integration ensures that your invoices, reports, and tax filings follow official regulations.

Support Business Growth

Integrated systems help streamline operations across accounting, HR, POS, and sales.

Accessible Anytime

Cloud systems let teams work remotely and collaborate from anywhere in the world.

How to Choose the Best Accounting Software in Saudi Arabia

Here are a few tips to help you select the perfect solution:

1. Identify Your Business Needs

Do you need:

- Basic invoicing?

- Full accounting + VAT?

- Inventory + POS?

- Payroll + HR?

Choose software that matches your business size and goals.

Confirm ZATCA Compliance

Always select a system certified by the Zakat, Tax and Customs Authority.

Check User-Friendliness

Your team should be able to understand and operate it easily.

Look for Cloud Features

Cloud systems offer better flexibility, security, and performance.

Compare Pricing

Avoid paying for unnecessary features. Many solutions offer free trials.

Consider Integration

Make sure the software can integrate with:

- POS

- CRM

- HR systems

- E-commerce platforms

Conclusion

Accounting software in Saudi Arabia has become essential for staying compliant, efficient, and competitive in 2026. With features like VAT automation, ZATCA e-invoicing, cloud access, and advanced reporting, these tools help businesses save time, reduce errors, and manage finances more effectively.

Whether you choose Bnody, Zoho Books, QuickBooks, Xero, or Sage, the key is to pick a solution that fits your operations, supports your growth, and ensures full compliance with Saudi regulations.

FAQs – Accounting Software in Saudi Arabia

1. Is accounting software mandatory in Saudi Arabia?

Not mandatory, but highly recommended due to VAT, ZATCA e-invoicing, and business digitalization requirements.

2. Which accounting software is best for small businesses in Saudi Arabia?

Bnody, Zoho Books, and QuickBooks Online are excellent options for small and medium enterprises.

3. What is ZATCA-compliant accounting software?

It is software approved by the Zakat, Tax and Customs Authority for generating e-invoices in XML/UBL format with QR codes.

4. Does accounting software support Arabic language?

Yes. Many solutions—including Bnody and Zoho—support both Arabic and English.

5. Can cloud accounting software work offline?

Cloud systems require internet access but allow users to log in from anywhere and any device.

6. Does accounting software help with VAT filing?

Yes. It automatically calculates VAT, prepares reports, and stores digital records for audits.

7. What businesses need accounting software the most?

Retail stores, restaurants, trading companies, services, wholesale, contracting, and e-commerce businesses.