In today’s interconnected world, the influence of global investors extends far beyond the walls of stock exchanges. Decisions made by a handful of strategic investors can ripple across markets, reshape industries, and even impact entire economies. Understanding how these investors operate, and why their actions matter, is crucial for anyone interested in financial markets or economic trends.

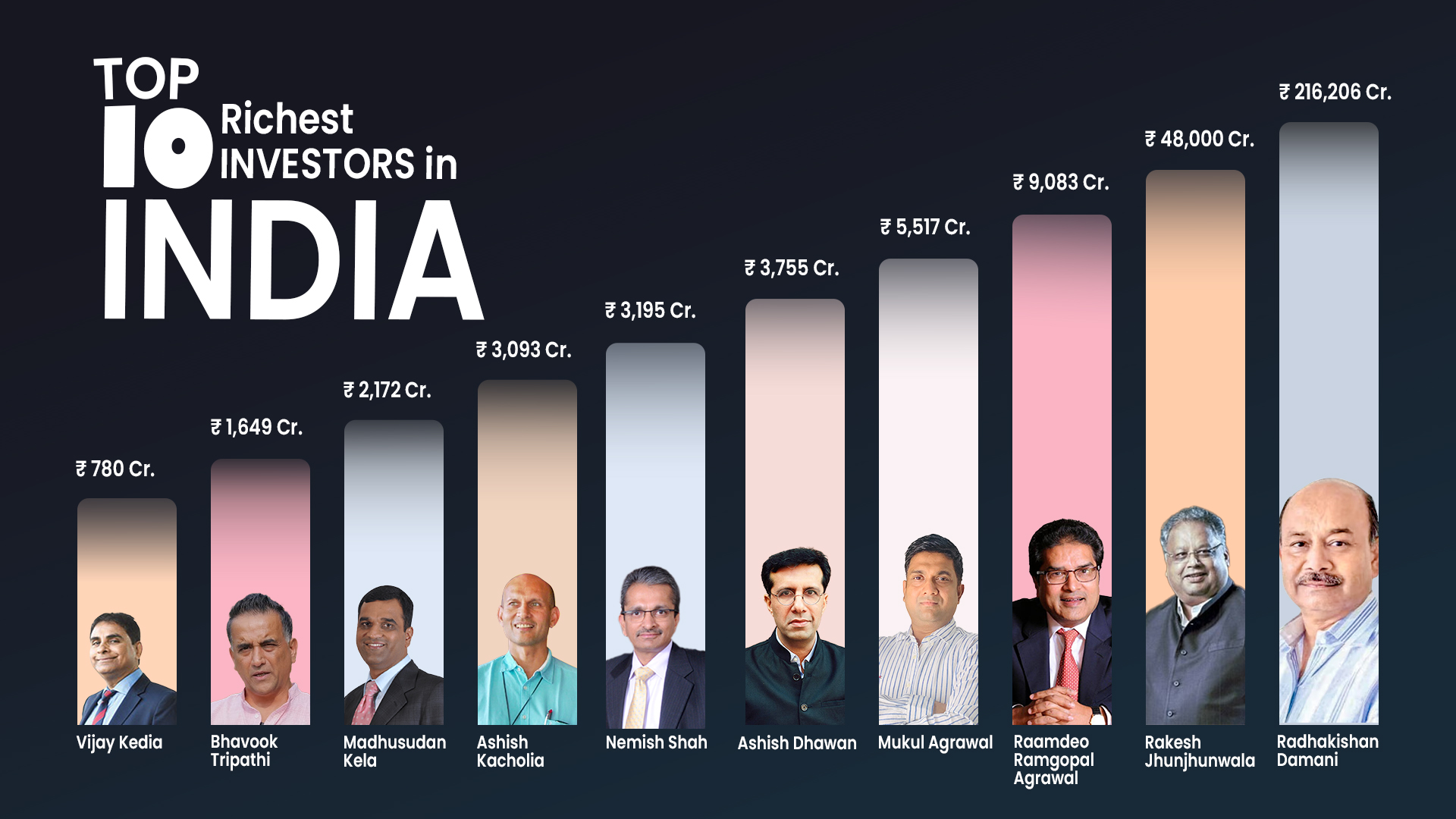

From the top investors in the world who drive major international investment flows to the Top Investors In India whose portfolios influence local market behavior, their collective impact is both profound and far-reaching. Let’s explore how global investors shape market trends and, in doing so, transform economies around the world.

1. Driving Market Sentiment and Capital Flows

Global investors wield significant influence on market sentiment. Their buying and selling decisions can trigger bullish or bearish trends across sectors and geographies.

When a prominent investor takes a position in a particular stock or sector, it often signals confidence in that area, encouraging other investors to follow suit. Conversely, large sell-offs by respected investors can spark panic and lead to broader market declines.

The result? Capital flows respond dynamically. Markets with higher foreign investment inflows often experience increased liquidity, lower borrowing costs, and improved business confidence — all of which fuel economic growth.

2. Impact on Stock Valuations and Corporate Strategies

Beyond sentiment, the choices of global investors directly affect stock valuations. Companies that attract large-scale institutional investment see their market value rise, which in turn allows them to raise capital more easily for expansion or innovation.

Moreover, influential investors often advocate for stronger corporate governance, transparency, and long-term strategies. Their involvement can push companies to improve operational efficiency, focus on sustainability, or diversify into high-growth sectors.

In India, for instance, the portfolios of Top Investors In India have often guided corporate decisions and inspired market participants to evaluate companies more critically, ultimately contributing to healthier capital markets.

3. Facilitating Global Economic Integration

Global investors play a key role in integrating economies worldwide. By investing across borders, they connect financial markets and enable capital to flow to regions with the highest potential for growth.

This cross-border investment brings several benefits:

- Knowledge transfer and exposure to international best practices

- Improved corporate governance and operational standards

- Access to global supply chains and technologies

- Strengthened domestic financial markets

As a result, markets are more interdependent, fostering innovation, efficiency, and competitiveness across industries.

4. Shaping Industry Trends and Innovations

The decisions of influential investors often determine which industries flourish. For instance, sectors like renewable energy, electric vehicles, and technology have received massive funding in recent years, largely due to the foresight of top global investors.

Their investments signal to other market participants that certain industries hold long-term promise, attracting additional capital and accelerating growth. This trend-setting effect not only drives market valuations but also promotes innovations that can transform daily life and economic structures.

5. Influencing Monetary and Fiscal Policy

Interestingly, global investors can indirectly affect government policies. Large-scale investments or divestments can influence currency strength, interest rates, and foreign exchange reserves.

Governments closely monitor these flows, adjusting fiscal or monetary measures to stabilize their economies. For example, when significant foreign investment pours into emerging markets, central banks may adjust interest rates to manage inflation or currency appreciation.

This demonstrates how investor behavior doesn’t just impact companies—it can shape national economic policies and macroeconomic stability.

6. Encouraging Transparency and Accountability

Reputable global investors often prioritize transparency, corporate governance, and sustainability. Their presence in a market encourages local companies to adhere to higher standards.

- Enhanced reporting standards

- Accountability in corporate decision-making

- Environmental, Social, and Governance (ESG) initiatives

Such improvements boost investor confidence, attract additional investment, and strengthen the overall market ecosystem.

7. Reducing Volatility Through Long-Term Investment

While short-term trades can amplify volatility, the participation of disciplined, long-term global investors tends to stabilize markets. By focusing on fundamentals rather than speculation, they provide a counterbalance to impulsive market behavior.

Long-term investors evaluate companies based on strategic potential, cash flow generation, and competitive advantages. Their involvement creates stability, encouraging other participants to adopt similarly rational approaches and contributing to healthier, less volatile markets.

8. Global Investors as Catalysts for Economic Growth

The influence of global investors goes beyond financial markets — it translates into tangible economic benefits:

- Job creation: Companies receiving funding can expand operations and hire more employees.

- Technological advancement: Capital investment drives research, innovation, and infrastructure development.

- Trade enhancement: Successful enterprises foster trade, both domestically and internationally.

- Wealth generation: Capital gains and dividends create financial security for households and institutional investors.

By strategically allocating capital, global investors not only grow their portfolios but also accelerate economic development in the countries where they invest.

9. Learning from the Best: Global and Indian Investors

Studying the strategies of the top investors in the world provides valuable lessons on diversification, patience, and analytical rigor. Similarly, the practices of Top Investors In India highlight the importance of adapting global insights to local markets.

Key takeaways include:

- Focus on quality businesses rather than short-term speculation

- Maintain a diversified yet purposeful portfolio

- Exercise patience and long-term vision

- Stay informed and continuously learn from market dynamics

Emulating these habits can help both retail and institutional investors navigate the complexities of modern financial markets.

10. The Future: Sustainability and ESG Investing

The next frontier for global investors is sustainability. With climate change, resource scarcity, and social equity gaining prominence, investors are increasingly prioritizing ESG-compliant companies.

This trend has far-reaching consequences:

- Encourages environmentally friendly and socially responsible business practices

- Shifts capital toward renewable energy, clean technology, and sustainable infrastructure

- Aligns economic growth with long-term planetary well-being

By influencing investment flows toward sustainable industries, global investors are helping shape not just markets but the future of economies themselves.

Conclusion: The Power and Responsibility of Global Investors

Global investors are more than capital providers—they are catalysts for innovation, economic development, and market efficiency. Their decisions influence industries, shape policies, and set trends that resonate across the world.

From the top investors in the world who steer international markets to the Top Investors In India who drive local growth, their collective impact underscores the interconnectedness of modern economies.

For individual investors, policymakers, and business leaders alike, understanding the behavior and strategies of these influential players is critical. By learning from their approaches—discipline, foresight, and strategic insight—anyone can better navigate markets and contribute to economic growth.

Global investors don’t just chase profits; they actively shape market trends and transform economies, leaving an indelible mark on the world of finance.