QuickBooks Error 2002 Fix Guide for 2026 Users: Get Your Payroll Back on Track

Navigating the world of digital accounting is usually a breeze until a sudden pop-up halts your momentum. If you’ve encountered QuickBooks Error 2002 while trying to manage your payroll or create a new company file, you aren’t alone. This specific glitch often strikes when the software encounters a sub-standard connection during a payroll update or when the system fails to verify your login credentials securely. In 2026, where security protocols are tighter than ever, ensuring your software is synced correctly is the first step toward a resolution.

Is QuickBooks Error 2002 blocking your payroll? Learn how to fix it fast with our 2026 guide. For expert help, call +1(866)500-0076 and get back to business.

What Exactly is QuickBooks Error 2002?

In technical terms, Error 2002 is a functional snag that appears when a user attempts to sign in to their payroll service or create a new data file, but the software fails to receive a response from the server. It’s essentially a “handshake” that didn’t happen.

Common triggers include:

- Outdated Payroll Tax Tables: Using old data in a new fiscal year.

- Incorrect EIN: A slight typo in your Employer Identification Number.

- Network Latency: Your internet dropped for a millisecond at the worst possible time.

- Damaged Components: Internal QuickBooks files that have become “corrupted” over time.

Step-by-Step Solutions to Resolve QuickBooks Error 2002

Don’t panic. Most of the time, this error is a software “hiccup” rather than a catastrophic failure. Follow these steps in order to clear the path.

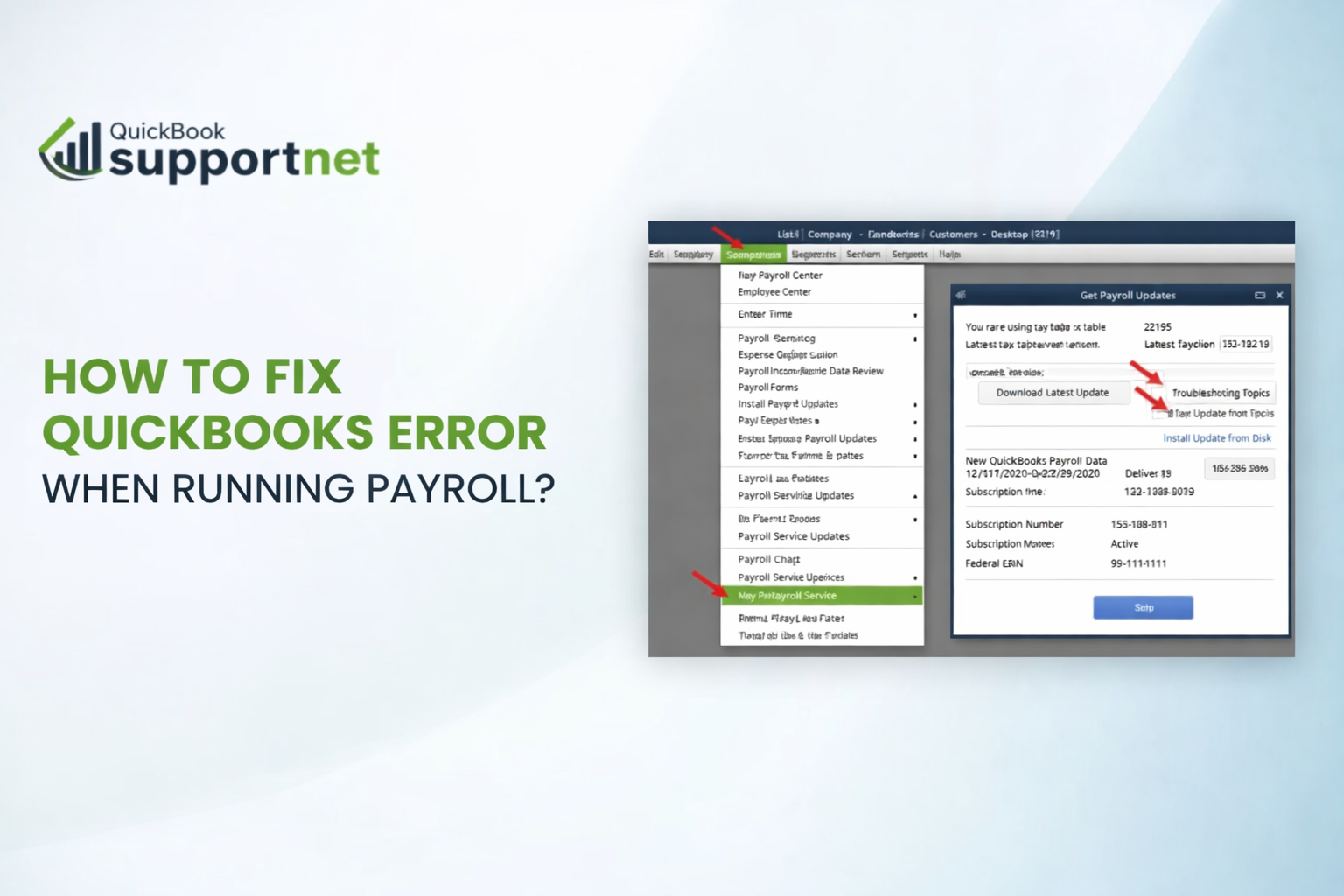

1. Update Your Payroll Tax Tables

In 2026, tax regulations move fast. If your QuickBooks isn’t running the latest tax table, it will trigger QuickBooks Error 2002 as a protective measure.

- Go to the Employees menu.

- Select Get Payroll Updates.

- Check the box for Download Entire Update.

- Click Update.

2. Run the QuickBooks Tool Hub

The Tool Hub is the “Swiss Army Knife” for accounting errors. It can sniff out damaged program files that manual searching might miss.

- Download and install the latest QuickBooks Tool Hub.

- Open the tool and navigate to Program Problems.

- Select Quick Fix My Program. This will shut down any lingering background processes that might be interfering with your payroll login.

3. Verify Your Employer Identification Number (EIN)

Sometimes the simplest solution is the right one. If QuickBooks cannot verify who you are, it won’t let you process payroll.

- Go to Company > My Company.

- Click on Federal Tax ID.

- Ensure there are no dashes, spaces, or typos in the number. Save any changes and restart the application.

4. Use the “Install Diagnostic Tool”

If the error persists, there might be an issue with the .NET Framework or C++ components on your Windows 11 or 12 machine.

- In the Tool Hub, go to Installation Issues.

- Click QuickBooks Install Diagnostic Tool.

- Let the tool run (it can take up to 20 minutes). Once finished, restart your computer and try opening your file again.

Why 2026 Users Face This More Often

As we move further into the decade, Intuit has integrated more AI-driven security layers. While this keeps your data safe, it also means that any “mismatch” in your user profile or digital certificate can lead to QuickBooks Error 2002. Keeping your Windows OS and your QuickBooks version fully patched is no longer optional—it’s a necessity for smooth operation.

Pro-Tips for Error Prevention

- Stable Fiber Connection: Avoid updating payroll over public Wi-Fi or unstable hotspots.

- Regular Backups: Always create a local backup before running major updates.

- Single User Mode: Perform administrative tasks like EIN changes or tax updates in Single User Mode to prevent data collisions.

Conclusion

Dealing with software glitches is a rite of passage for modern business owners. While QuickBooks Error 2002 can be frustrating, the steps above should get your wheels turning again. Beyond just fixing errors, mastering the software allows you to unlock its full potential. For instance, once your payroll is back online, you can efficiently Create and Record Checks in QuickBooks, ensuring your vendors and employees are paid on time without a hitch.

By staying proactive with updates and utilizing the Tool Hub, you turn a potential day-ruiner into a five-minute fix. If you ever find yourself stuck, remember that professional support is just a phone call away at +1(866)500-0076.

Frequently Asked Questions

Q1: Will Error 2002 delete my payroll data?

No. This error is a connectivity and verification issue. Your data remains stored in your .qbw file; the software is simply struggling to access the payroll server or verify your identity.

Q2: I updated my tax tables, but the error is still there. What now?

Check your firewall settings. Sometimes, 2026 security software sees the QuickBooks update as a “threat” and blocks the port. Add QuickBooks as an exception in your firewall settings.

Q3: Can I fix this error on QuickBooks Mac?

While the error code might differ slightly, the logic is the same: verify your internet, check your EIN, and ensure your software is updated to the latest version compatible with your macOS.

Q4: How often should I update QuickBooks to avoid these errors?

Ideally, you should check for updates once a week. However, setting your “Automatic Update” feature to “On” is the best way to prevent errors like QuickBooks Error 2002 from occurring in the first place.

Q5: Who can I call for immediate help?

If you have tried the steps above and are still unable to process payroll, contact the dedicated support line at +1(866)500-0076 for expert assistance.

Read More:- How to Fix QuickBooks Error 0000: Proven Troubleshooting Guide